Ciao ragazzi,

as mentioned in my latest portfolio update, I opened a position in Nebius as I think there is a chance of it becoming the first $100bn AI company in Europe. Given its valuation of ~$10bn (of which $2bn in cash) the upside is huge.

The core tenets of this thesis are:

a) AI delivers on its promise of economic benefits

b) scaling law (more compute generally lead to better AI performance) keeps applying

I have written about why I believe this is the case here but in extreme synthesis: we are just at the beginning of the AI journey and the AI models will now move from text to video and physical word scenarios which are much more complex and compute heavy.

I would classify this investment as VC-type. Nebius has little revenues, is loss-making, is growing extremely fast and is very volatile. There is a non-0 chance that his investment will go to 0. After I purchased the stock it went down significantly following tariff news, political instability and a comment of Microsoft CEO about data centre expenditure increasing too much. I have kept the valuation numbers as they were when I took my decision. At today’s price it is much more attractive and I am adding a few shares to my initial position.

One of earth`s best tech founders - all in on this 🎲

Arkady Volozh co-founded Yandex, Russia’s Google which reached a market cap of about $30bn. In July 2024, Yandex sold its Russian assets, retaining several businesses operating outside of Russia, and was renamed Nebius Group. In the process, he moved to Israel and became an Israeli citizen.

Volozh holds ~13% of Nebius worth about $1.3bn accounting for almost all of his net worth. (Forbes).

Here you can find an interview to get to know him and his life story.

Core business - vertically integrated AI Infra 🔗

Nebius is a fully vertically integrated AI infrastructure provider meaning they take care of all the steps in the value chain from the building that contains the servers, to the customer facing software product to deploy AI model and everything in the middle.

To help put this in perspective here is a visualization of the AI Value chain, in red you see where Nebius is.

Owning many steps of the value chain allows Nebius to be innovative and deliver best-in-class results in power efficiency and price.

Strategic investment from NVIDIA + VC investment from Accel💰

I became aware of Nebius because NVIDIA and Accel invested in Q4 2024 in a $700m round (Link). This is important because:

NVIDIA is the only supplier (for now) of GPUs and right now in the middle of AI infra ramp-up years, GPUs sell like water in the desert. NVIDIA only invested in Nebius in Europe when it comes to AI infra and data centers.

Accel is one of the very best VCs, I see their investment as a validation sign and the fact they performed due diligence makes me sleep a little bit better

Hypergrowth driven by AI, strategic for Europe 🌍

Nebius is growing insanely fast as AI infra demand is insatiable…..

….and could continue to do so fuelled by its strategic alliance with NVIDIA…

…and pushed by the need of EU to have an AI infrastructure champion

Nebius is so much more than AI infra 👀

Nebius owns 3 other businesses (Toloka, Avride, Tripleten) plus a ~30% participation in Clickhouse. Most of the narrative that I read about these businesses is “wow these are very cool businesses and you get them on top of the core AI business". I see it a bit differently; those businesses are in fact strategic and beautifully interconnected.

Toloka - human experts for AI models

Supports Nebius AI customers to fine-tune and evaluate their models. Its revenues grew 140% in 2024. AI models need human in loop to fine-tune → it boots sales of Nebius core AI and viceversa

Clickhouse - open source database for real-time large dataset analytics

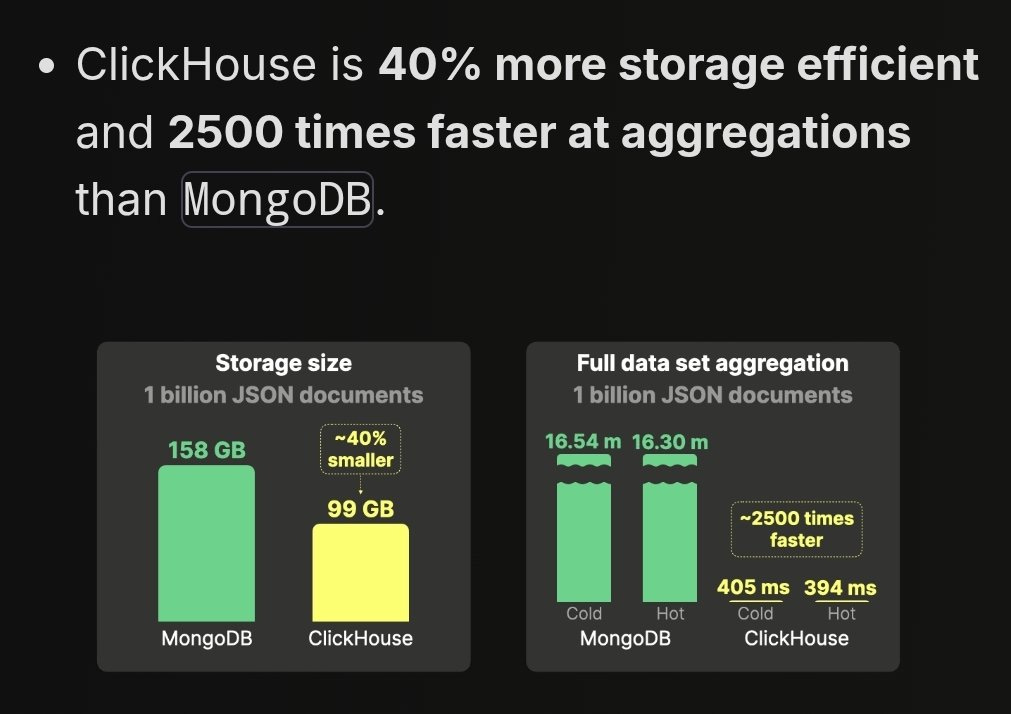

Clickhouse is a frontrunner in large dataset real-time DB. Technically inferior to none and with an open source traction much bigger than MongoDB. They raised $300m from the very best VCs in the world (Index, Benchmark, Lightspeed) → Clickhouse supports data workloads management and preparation to train AI models. The same AI models that can be trained on the Nebius AI platform and then fine tuned with humans in the loop via Toloka. Can you see the flywheel manifesting?

Avride - fully autonomous cars and delivery robots

Avride develops fully autonomous driving cars and delivery robots. I do not know this for sure but I would be surprised if Avride does not leverage Nebius AI infra, Clickhouse and Toloka to respectively host their AI models, have humans supporting in fine-tuning and managing the enormous data workloads. Again, it’s all interconnected.

Avride signed in Q4 2024 and Q1 2025 partnerships with Hyunday (autonomous cars) Uber and Grubhub (delivery robots).

Tripleten - reskilling bootcamp

Tripleten offers reskilling services with a focus on software engineering, data science, cyber security. They are not doing it yet but I can imagine in future they will train AI engineers using the Nebius platform and data scientist using Clickhouse. Graduates will then bring the tools that they know in the companies that hired them. Also Nebius might hire the best graduates for themselves. Cherry of the top: Tripleten revenues are growing 2x y-o-y now at ~$50m.

Road to 100bn 🛣️

Nebius potential is enormous and could stack up to a $100bn company one day. Just by looking at comparable companies today:

AI infra - Corewave is about to IPO at $40bn valuation (Link)

Avride - Waymo was valued at $45bn in October (Link)

Clickhouse - MongoDB market cap is ~$20bn

Obviously, I am not saying that just because it competes against Corewave, Avride or MongoDB, Nebius has a claim to the same valuations as its competitors. I am just using comparable companies to quantify the best possible outcome.

Another way to look at it is to try estimating future revenues of Nebius. Only core AI:

In the coming years the need for AI infrastructure could 5-10x sustained by agentic AI and Physical AI. (see my reasoning here)

To gauge the size of the AI infrastructure market in future let´s take NVIDIA data center revenues today and 5x it. It yields to ~ $500bn.

If we further assume that companies such as Nebius sell GPU at ~2x their purchase price we are left with a $1tr market.

If Nebius only wins 1% of this market, it will make $10bn in revenues and with a 10x EV/Sales multiple a $100bn company

Loss-making and will stay so for a while 🔥

Nebius has a clear road to hypergrowth in the AI infra business and a potential huge outcome in the autonomous driving business line. To fuel growth steep investments are required. I expect Avride to be loss-making for at lest 2 years.

A jungle of risks 💀

Will AI data center expenditure and demand stabilize/ increase/ decrease?

Will Nebius turn the AI core business into profit?

Nvidia could back other EU AI infra companies

AMD’s CPU could become a valid alternative to NVIDIA GPU thus making the partnership with Nebius less unique

Will Nebius turn to revenue and then to profit the autonomous driving business unit?

And that's it! Please let me know if you liked it, what I can improve, and if you think this newsletter could help a friend, please send it to them!#

Federico

Please remember that everything written in this newsletter/website is for educational purposes only and should not be interpreted as financial, legal, or tax advice. The opinions, analyses, information, or recommendations expressed here are solely my own. Remember that financial decisions involve risks and should be made based on your own personal circumstances and after consulting a qualified professional.

Such a peculiar story. It will be fascinating to see how the three ancillary businesses evolve!

Amazing read!